The Shaving Cadre

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Reading Lounge

- Thread starter dangerousdon

- Start date

woodpusher

TSC’s International Man of Meh

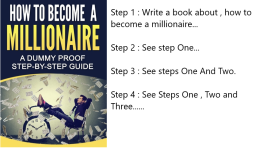

I finished reading The Idiot Millionaire last night, but being honest , I skipped about 90% of the book. Why? Because the advocated path to becoming wealthy is to simply pick stocks that:

a) will go up in value,

b) will increase their dividends over time, and

c) will have the company engage in stock buy-backs on a semi-regular basis.

Well .... in a word ..... duh! It would be great to have a time machine to look ahead 10, 20, or even 30+ years. Even the author acknowledges that future performance is not predictable based on past performance, but he says that since that's the best information you have, that's what you should use. Nary a word at all about simply buying the market through index funds or any commentary on how professional fund managers and stock pickers under perform in the long run.

As for why I skipped 90% of the book, it's because that amount of space is taken up by the author identifying and analyzing the 50 stocks you should buy.

Verdict: Hard Pass

a) will go up in value,

b) will increase their dividends over time, and

c) will have the company engage in stock buy-backs on a semi-regular basis.

Well .... in a word ..... duh! It would be great to have a time machine to look ahead 10, 20, or even 30+ years. Even the author acknowledges that future performance is not predictable based on past performance, but he says that since that's the best information you have, that's what you should use. Nary a word at all about simply buying the market through index funds or any commentary on how professional fund managers and stock pickers under perform in the long run.

As for why I skipped 90% of the book, it's because that amount of space is taken up by the author identifying and analyzing the 50 stocks you should buy.

Verdict: Hard Pass

Last edited:

I finished reading The Idiot Millionaire last night, but being honest , I skipped about 90% of the book. Why? Because the advocated path to becoming wealthy is to simply pick stocks that:

a) will go up in value,

b) will increase their dividends over time, and

c) will have the company engage in stock buy-backs on a semi-regular basis.

Well .... in a word ..... duh! It would be great to have a time machine to look ahead 10, 20, or even 30+ years. Even the author acknowledges that future performance is not predictable based on past performance, but he says that since that's the best information you have, that's what you should use. Nary a word at all about simply buying the market through index funds or any commentary on how professional fund managers and stock pickers under perform in the long run.

As for why I skipped 90% of the book, it's because that amount of space is taken up by the author identifying and analyzing the 50 stocks you should buy.

Verdict: Hard Pass

woodpusher

TSC’s International Man of Meh

^^^

That pretty much sums up several of the books I have read.

That pretty much sums up several of the books I have read.

EMG06

"TSC's Bingo Admiral"

woodpusher

TSC’s International Man of Meh

I just finished reading A Gentleman in Moscow yesterday. It tells the story of a Russian Count who, just after the Russian revolution, finds himself sentenced to house arrest at a Moscow hotel with orders to be shot should he step outside. The tale spans several decades and offers some very nice jewels of interactions and insights into people, while tending to move a bit slower in the middle third of the book. It's not a can't-put-down-once-you-pick-it-up page-turner, but it is a nice way to spend relaxing while watching the story unfold. I kept finding myself wanting to reach for a glass of wine with partaking in the stories of the good Count.

VERDICT: Worth picking up.

VERDICT: Worth picking up.

woodpusher

TSC’s International Man of Meh

After getting through a few stories in my near 800 page Lovecraft book, I picked up the eBook version of 7 Steps to Get Out of Debt and Build Wealth. It's getting harder and harder for me to find things of interest to read in the field of personal finance and I was hoping for something with a different perspective with this one, especially with the "build wealth" component.

Alas, it is basically a kinder, gentler version of the Dave Ramses approach of "Credit card bad," "Snowball your debt payments," (disclaimer, I am a debt avalanche proponent, but understand that snowballing will be better for some people), "Move your debt snowball to savings snowball when debt free."

VERDICT: Meh, pass. If you have debt and don't know where to start, as much as I dislike Ramses, he explains the process better.

Alas, it is basically a kinder, gentler version of the Dave Ramses approach of "Credit card bad," "Snowball your debt payments," (disclaimer, I am a debt avalanche proponent, but understand that snowballing will be better for some people), "Move your debt snowball to savings snowball when debt free."

VERDICT: Meh, pass. If you have debt and don't know where to start, as much as I dislike Ramses, he explains the process better.

So you’re a masterbooker just like me.

beginish

The Dr. Who of the TSC

Only 2 months and one day for me

beginish

The Dr. Who of the TSC

Is that what the kids call it these days?So you’re a masterbooker just like me.

No, no it's not.Is that what the kids call it these days?

woodpusher

TSC’s International Man of Meh

I just finished reading The Chancellor, a biography of Angela Merkel. Written very much in a no-nonsense style that exhibits purpose in its content and is not driven to hyperbole, the author has very much embraced delivering Merkel's story in a manner which reflects her subject very well. I enjoyed the easy reading flow and heartily recommend it.

Verdict: Highly Recommended

Verdict: Highly Recommended

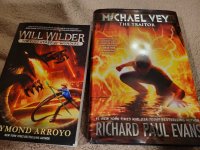

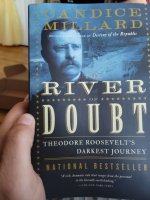

I I finished the above book Will Wilder it's a really good series and I'd recommend it for sure. Now back to some non fiction.Finally back home from Chicago. Finished the book on the left. Started the one on the right

View attachment 119963

woodpusher

TSC’s International Man of Meh

I've taken Chad's recommendations before (and suffered for them), but Will Wilder: The Relic of Perilous Falls is a young adult cross of Indiana Jones and Percy Jackson. I've read much worse, but this was something easy to read without having to pay attention to details. I'm assuming Chad read it for his young'uns, but I'm not too sure, if ya know what I mean.

In any event, it's better than peach whiskey.

In any event, it's better than peach whiskey.

I read them with my 9 year old. Book 3 has been our favorite thus far.I've taken Chad's recommendations before (and suffered for them), but Will Wilder: The Relic of Perilous Falls is a young adult cross of Indiana Jones and Percy Jackson. I've read much worse, but this was something easy to read without having to pay attention to details. I'm assuming Chad read it for his young'uns, but I'm not too sure, if ya know what I mean.

In any event, it's better than peach whiskey.

View attachment 122112

I'd rather read with my children then put them in front of an idiot box I mean TV.

woodpusher

TSC’s International Man of Meh

Reading is good!

BTW I've placed a hold at the library for the 2nd book in the series.

BTW I've placed a hold at the library for the 2nd book in the series.