The Shaving Cadre

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Reading Lounge

- Thread starter dangerousdon

- Start date

woodpusher

TSC’s International Man of Meh

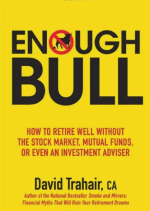

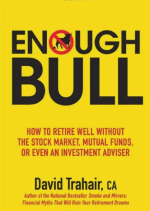

While waiting for an inter-library loan book to arrive, I picked up one that I had little hope for after reading the reviews. Enough Bull lived up to expectations and was very much the expected disappointment.

You can see what the subtitle is and the book's plan in the first half is all about:

- pay off your debt,

- don't carry a credit card balance,

- pay off your mortgage,

- reduce your expenses

- don't save a penny until all of the above are done

- ditch your investment advisor

The first four make sense, but the last two have me thinking someone doesn't have a clue what they're talking about. The recommendation is to 100% steer clear of the stock market and bonds because they are horrible and you WILL lose everything just like what happened in the 2008 housing bubble (which this book was written right after). Instead buy GICs and only GICs.

BTW the last point in "then plan" is actually moot as why would you even have an advisor in the first place if you have no savings for most of our working life and then only bought GICs when you started to save?

The best part is first discussed in the last few pages on how to retire well once you feel you are are ready to retire.

1) Delay retirement and keep working longer

2) Spend less

3) Earn money in retirement

Sounds reasonable, right? But he recommends that you think about buying a rental property to generate income if you don't have enough income to see to your needs? Duh!!! Also, starting a corporation might be a good thing to do if money is tight when you are retired. Double-Duh!

Thankfully, the whole thing can be read in a day.

VERDICT: HARD PASS

While I was reading this pile of cakka-doo-doo, the book I was waiting for has arrived! Woot!

You can see what the subtitle is and the book's plan in the first half is all about:

- pay off your debt,

- don't carry a credit card balance,

- pay off your mortgage,

- reduce your expenses

- don't save a penny until all of the above are done

- ditch your investment advisor

The first four make sense, but the last two have me thinking someone doesn't have a clue what they're talking about. The recommendation is to 100% steer clear of the stock market and bonds because they are horrible and you WILL lose everything just like what happened in the 2008 housing bubble (which this book was written right after). Instead buy GICs and only GICs.

BTW the last point in "then plan" is actually moot as why would you even have an advisor in the first place if you have no savings for most of our working life and then only bought GICs when you started to save?

The best part is first discussed in the last few pages on how to retire well once you feel you are are ready to retire.

1) Delay retirement and keep working longer

2) Spend less

3) Earn money in retirement

Sounds reasonable, right? But he recommends that you think about buying a rental property to generate income if you don't have enough income to see to your needs? Duh!!! Also, starting a corporation might be a good thing to do if money is tight when you are retired. Double-Duh!

Thankfully, the whole thing can be read in a day.

VERDICT: HARD PASS

While I was reading this pile of cakka-doo-doo, the book I was waiting for has arrived! Woot!

Dude, that pile of cakka -doo-doo is how I have been doing it for ten years!While waiting for an inter-library loan book to arrive, I picked up one that I had little hope for after reading the reviews. Enough Bull lived up to expectations and was very much the expected disappointment.

You can see what the subtitle is and the book's plan in the first half is all about:

- pay off your debt,

- don't carry a credit card balance,

- pay off your mortgage,

- reduce your expenses

- don't save a penny until all of the above are done

- ditch your investment advisor

The first four make sense, but the last two have me thinking someone doesn't have a clue what they're talking about. The recommendation is to 100% steer clear of the stock market and bonds because they are horrible and you WILL lose everything just like what happened in the 2008 housing bubble (which this book was written right after). Instead buy GICs and only GICs.

BTW the last point in "then plan" is actually moot as why would you even have an advisor in the first place if you have no savings for most of our working life and then only bought GICs when you started to save?

The best part is first discussed in the last few pages on how to retire well once you feel you are are ready to retire.

1) Delay retirement and keep working longer

2) Spend less

3) Earn money in retirement

Sounds reasonable, right? But he recommends that you think about buying a rental property to generate income if you don't have enough income to see to your needs? Duh!!! Also, starting a corporation might be a good thing to do if money is tight when you are retired. Double-Duh!

Thankfully, the whole thing can be read in a day.

VERDICT: HARD PASS

View attachment 88375

While I was reading this pile of cakka-doo-doo, the book I was waiting for has arrived! Woot!

Salinger’s ‘Catcher in the Rye’. I read it every ten years because a teacher told me your perception of Holden will change dramatically through different phases of your life. I first read it when I was 13. He is right.

I wonder if Mark David Chapman does the same.

I wonder if Mark David Chapman does the same.

woodpusher

TSC’s International Man of Meh

My concern/issue that he is saying that the market WILL cause you to lose everything. Not "might" but "will" and that GICs are the ONLY way to save. Nothing wrong with GICs at all when you are already retired and just need to earn enough interest to supplement your income along with periodically drawing down some capital, but if you invested in only GICs after paying off your mortgage and had no savings before that, I'm not sure you would be able to create a large enough nest egg to "retire well." Perhaps my concept of retiring well is different than the author's?Dude, that pile of cakka -doo-doo is how I have been doing it for ten years!

I think this book was simply written to capitalize on people fleeing the housing-induced stock market crash looking for something/anything less risky. The concept of buying a rental property to make extra income if you already don't have enough income to live on is a head-scratcher as well. Additionally, buying a rental property is investing in real estate and didn't the author say that the ONLY investment should be GICs?

While many of the other books I have read have not been perfect, at least most seemed to strive to educate the reader into making investment decisions based on their own personal financial circumstances, tolerance for risk, and age (i.e. years of income production still available). This book is a one-size-fits-all fear-of-the-market cookie cutter which intermixes some good common-sense ideas on debt management with investment policies that are probably not appropriate for most people.

All financiers are full of crap to some degree. So I concur.My concern/issue that he is saying that the market WILL cause you to lose everything. Not "might" but "will" and that GICs are the ONLY way to save. Nothing wrong with GICs at all when you are already retired and just need to earn enough interest to supplement your income along with periodically drawing down some capital, but if you invested in only GICs after paying off your mortgage and had no savings before that, I'm not sure you would be able to create a large enough nest egg to "retire well." Perhaps my concept of retiring well is different than the author's?

I think this book was simply written to capitalize on people fleeing the housing-induced stock market crash looking for something/anything less risky. The concept of buying a rental property to make extra income if you already don't have enough income to live on is a head-scratcher as well. Additionally, buying a rental property is investing in real estate and didn't the author say that the ONLY investment should be GICs?

While many of the other books I have read have not been perfect, at least most seemed to strive to educate the reader into making investment decisions based on their own personal financial circumstances, tolerance for risk, and age (i.e. years of income production still available). This book is a one-size-fits-all fear-of-the-market cookie cutter which intermixes some good common-sense ideas on debt management with investment policies that are probably not appropriate for most people.

woodpusher

TSC’s International Man of Meh

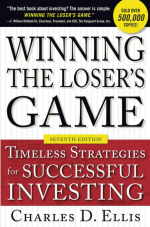

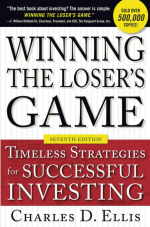

Winning The Loser's Game is a book I have been wanting to read for a few months, but had to wait for it to come in via the inter-library load program. It was worth the wait.

Ellis is a proponent of index ETF investing and spends a good bit of time rehashing three main themes throughout the entire book:

- Investment Advisors are so skillful today, that there is no way any one of them can continually beat all the rest of the other professionals in the industry (i.e. the market, which basically is the combined valuation of all the best institutional pros in the world)

- Investment Advisor fees eat up a large chunk of your profits (e.g. a 2% fee when there is a 7% return is really a 28% fee)

- Index ETFs address these issues (low fees and by tracking the market, you have all the market professionals working for you)

In addition to the book being about twice as long as needed (due to the same 3 ideas being repeated over and over and over), it still is a worthwhile read. Hoevere, there are a few things of note:

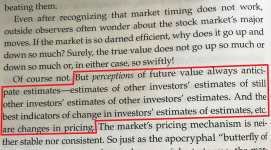

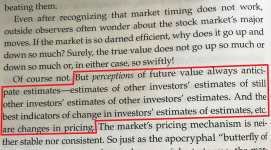

I understand what he's saying (e.g. I know that you know that I know that you know...), but the same sentence is basically repeated at about 3-4 different places in the book and simply makes for awkward reading.

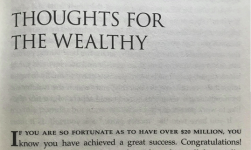

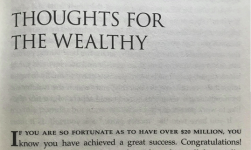

Somehow, I am not sure a person with $20 million is going to be doing much of their own reading and decision making. (Of course, *I* would! ) In any event, a whole chapter on this is probably missing the common person.

) In any event, a whole chapter on this is probably missing the common person.

But of course, there is something WONDERFUL hidden inside!...

Sadly, he does not get into discussions on the Lucena or Philidor positions.

VERDICT: HIGHLY RECOMMENDED

I think that is pretty much all the finance reading that is out there for me at present.... unless I want to read the government's tax code update publications. For the foreseeable future (unless something pops up and catches my attention), I will be back into the land of fantasy, sci-fi, hooror, and classics.

Ellis is a proponent of index ETF investing and spends a good bit of time rehashing three main themes throughout the entire book:

- Investment Advisors are so skillful today, that there is no way any one of them can continually beat all the rest of the other professionals in the industry (i.e. the market, which basically is the combined valuation of all the best institutional pros in the world)

- Investment Advisor fees eat up a large chunk of your profits (e.g. a 2% fee when there is a 7% return is really a 28% fee)

- Index ETFs address these issues (low fees and by tracking the market, you have all the market professionals working for you)

In addition to the book being about twice as long as needed (due to the same 3 ideas being repeated over and over and over), it still is a worthwhile read. Hoevere, there are a few things of note:

I understand what he's saying (e.g. I know that you know that I know that you know...), but the same sentence is basically repeated at about 3-4 different places in the book and simply makes for awkward reading.

Somehow, I am not sure a person with $20 million is going to be doing much of their own reading and decision making. (Of course, *I* would!

But of course, there is something WONDERFUL hidden inside!...

Sadly, he does not get into discussions on the Lucena or Philidor positions.

VERDICT: HIGHLY RECOMMENDED

I think that is pretty much all the finance reading that is out there for me at present.... unless I want to read the government's tax code update publications. For the foreseeable future (unless something pops up and catches my attention), I will be back into the land of fantasy, sci-fi, hooror, and classics.

woodpusher

TSC’s International Man of Meh

beginish

The Dr. Who of the TSC

I don’t think I’ve read that one. My daughter did though and liked it. I’m currently reading The Puzzler by AJ Jacobs, a deep dive into all sorts of puzzles like crosswords, Rubiks Cube, etc.I just finished reading Where the Crawdads Sing and it has been a while since a read a book that flowed so easily and was so immersive. I don't mind saying that I could feel tears welling up near the end. Hey, @beginish , you should read this one again.

VERDICT: Highly Recommended

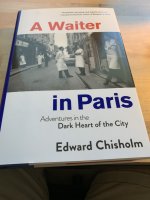

View attachment 90017

woodpusher

TSC’s International Man of Meh

Say what?!?!????? It was partially based on your post I read it.I don’t think I’ve read that one. My daughter did though and liked it. I’m currently reading The Puzzler by AJ Jacobs, a deep dive into all sorts of puzzles like crosswords, Rubiks Cube, etc.

Educated is unputdownable. My daughter got it for Christmas last year, disappeared to her room and came out for dinner having finished it. I did it on audio. Deeply disturbing on so many levels. It ain’t Where the Crawdads Sing.

The Cutthroat Journey

Shave Member

beginish

The Dr. Who of the TSC

Ah. I threw shade at Crawdads. I didn’t say I read it!Say what?!?!????? It was partially based on your post I read it.

woodpusher

TSC’s International Man of Meh

You go, girl!

woodpusher

TSC’s International Man of Meh

GearNoir

“The Meme Savant of the TSC”

Interesting present…On my trip to Nova Scotia, my niece gave me Life With Billy to read. It is a disturbing story about an abused wife who killed her husband back in the ‘80s that takes place around 40 miles from here.

Verdict: Recommended, but it is not an enjoyable story.

View attachment 91604

Blink once if you feel unsafe right now Sam…

woodpusher

TSC’s International Man of Meh

It’s a loaner, not a gift. She has yet to read it herself but she knows the basic story. I told her that it should be mandatory reading for any guest that stays more than a week.

GearNoir

“The Meme Savant of the TSC”

Is it a food book? A love novella? A crime novel? An action packed thriller?

Yes!