I think I’ll just rewatch Freaky Friday.A key premise of the book is that like Schrödinger’s cat, if it’s not observed then it is both alive and dead simultaneously. Now apply that logic to a human who is dead but not observed to be that way and the ‘live’ one continues to go on. Hilarity ensues.

The Shaving Cadre

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

The Reading Lounge

- Thread starter dangerousdon

- Start date

beginish

The Dr. Who of the TSC

So Schrod's Ball was sort of the same "fun read" for you as the first 3rd of the SillyMarrillion was for me?

Gormenghast ... I think I've heard that name before.Looking forward to your take on it.

At least ‘Ball’ was only 200 pages.

I’m lining up the Silmarillion for later this summer to be followed by the 3 deep dive books Chris Tolkien did before his death into the 3 main stories of the First Age (The Children of Hurin; Beren and Luthien; The Fall of Gondolin).

woodpusher

TSC’s International Man of Meh

This is one of the easier books to read on investing as there is not a great deal of focus on numbers, numbers, and compounded numbers. The first chunk on the book deals with looking at market bubbles over the past few hundred years up to dot.coms and even the housing crisis. Then, a review of modern investment theories including smart-beta and such, finally followed by the last bit of the book which basically says something along the lines of "Since these approaches have not beaten the market over the long term, just buy the market (aka. indices)"We interrupt the deep dive into dreary dysfunctional dystopia to bring you.....

View attachment 84330

In investing speak, my return to this type of book would be called an expected "reversion to the mean."

All in all, VERDICT: RECOMMEND

Last edited:

I am gonna check my couch cushions and winter coat pockets for disposable income and get back to you.This is one of the easier books to read on investing as there is not a great deal of focus on numbers, numbers, and compounded numbers. The first chunk on the book deals with looking at market bubbles over the past few hundred years up to dot.coms and even the housing crisis. Then, a review of modern investment theories including smart-beta and such, finally followed by the last bit of the book which basically says something along the lines of "Since these approaches have not beaten the market over the long term, just buy the market (aka. indices)"

All in all, VERDICT: RECOMMEND

woodpusher

TSC’s International Man of Meh

@August West , My investment advice is easily worth double what you've paid so far.

woodpusher

TSC’s International Man of Meh

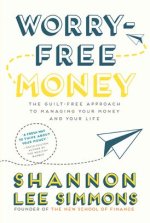

WORRY-FREE MONEY (not to be confused with WORRY, FREE MONEY  ) is a light read about how to manage your finances, using the following approach (which I am oversimplifying):

) is a light read about how to manage your finances, using the following approach (which I am oversimplifying):

- pay yourself first

- pay your fixed MUST PAY expenses next

- Establish and emergency fund

- Save some towards retirement

- Get rid of your debt

- Spend anything and everything left over

I view it as a Dave Ramses "Light" approach.

- pay yourself first

- pay your fixed MUST PAY expenses next

- Establish and emergency fund

- Save some towards retirement

- Get rid of your debt

- Spend anything and everything left over

I view it as a Dave Ramses "Light" approach.

Have you read any C.S. Lewis?View attachment 85134

Was a little slow finishing the book on the right, but I did. Now reading the one on the left.

Yes most of his worksHave you read any C.S. Lewis?

woodpusher

TSC’s International Man of Meh

woodpusher

TSC’s International Man of Meh

The Value of Simple is a short and easy to read book took only 3 post-morning-coffee sessions of reading to devour. It is an EXCELLENT starter guide on passive investing that is geared towards the Canadian investor and, unlike many "introductory/beginner" books, this one doesn't have 475 tables of technical information about compounding returns, historical market rolling averages, etc....

Plain and simply, it's an excellent introduction.

VERDICT: HIGHLY RECOMMEND

Plain and simply, it's an excellent introduction.

VERDICT: HIGHLY RECOMMEND

global_dev

Shave Enthusiast

I’m about to start reading Atomic Habits. Anyone already read it?

Are the classics dead?

NickCard

Sr. Shave Member

Are the classics dead?

That would be a shame as they are classics for good reason. If you were to see a HS English reading list today, however, you may very well have an argument that the classics are “dead” or dying a slow death.

woodpusher

TSC’s International Man of Meh

BOOM!! Beat the Bank is the 2018 book we all needed to read 30 years ago! My current self didn't learn anything new, but this does a great job explaining how Bay Street (Canada's Wall St) brokers do an excellent job of siphoning off an investor's gains via fees.

VERDICT: EXCELLENT!!! (Even for Americans!)

VERDICT: EXCELLENT!!! (Even for Americans!)

woodpusher

TSC’s International Man of Meh

How to Retire Happy is not a book on how to either:

a) prepare for retirement financially, nor

b) how to structure your finances (savings and expenses) while in retirement.

Rather, it is a book that lightly discusses various aspects of retirement (friends, where to live, early/late SSA, medicare/medicaid....).

Geared to the American market, I sped read / scanned about 1/2 the book as the topics such as US taxation do not easily transfer to Canadian life. I found very little of value. Indeed, simply Googling topics about retirement preparation will probably give you better information.

VERDICT: PASS (maybe okay to read if you are an American and have not done any thinking about it yet)

a) prepare for retirement financially, nor

b) how to structure your finances (savings and expenses) while in retirement.

Rather, it is a book that lightly discusses various aspects of retirement (friends, where to live, early/late SSA, medicare/medicaid....).

Geared to the American market, I sped read / scanned about 1/2 the book as the topics such as US taxation do not easily transfer to Canadian life. I found very little of value. Indeed, simply Googling topics about retirement preparation will probably give you better information.

VERDICT: PASS (maybe okay to read if you are an American and have not done any thinking about it yet)

woodpusher

TSC’s International Man of Meh

Another book down and, yes, @NurseDave , you guessed it .... another investment book!

Sleep-Easy Investing is geared towards the Canadian audience with little understanding of how markets work and the difference between a stock and a bond. It is from 2008 ,,, and it shows. It does a very nice job about explaining stocks, bonds, GICs, T-Bills, Mutual Funds, and Money Market accounts. However, it does a horrible job introducing you to ETFs. As far as I can tell, he thinks ETFs ONLY track market Indeces and are all passive. This is true for "couch potato" appropriate investors (like me!) but you can also find numerous ETFs that use hedging and derivatives to be as actively managed and un-indexlike as any mutual fund or selection of hand-picked stocks.

VERDICT: A dual-verdict!

RECOMMENDED for general introduction to the various holdings (NOTE: The book is grossly out-of-date when it comes to asset allocation recommendations)

HARD PASS for all the the ETF information (You also will NOT find any TFSA information as that came about after the book was published)

Sleep-Easy Investing is geared towards the Canadian audience with little understanding of how markets work and the difference between a stock and a bond. It is from 2008 ,,, and it shows. It does a very nice job about explaining stocks, bonds, GICs, T-Bills, Mutual Funds, and Money Market accounts. However, it does a horrible job introducing you to ETFs. As far as I can tell, he thinks ETFs ONLY track market Indeces and are all passive. This is true for "couch potato" appropriate investors (like me!) but you can also find numerous ETFs that use hedging and derivatives to be as actively managed and un-indexlike as any mutual fund or selection of hand-picked stocks.

VERDICT: A dual-verdict!

RECOMMENDED for general introduction to the various holdings (NOTE: The book is grossly out-of-date when it comes to asset allocation recommendations)

HARD PASS for all the the ETF information (You also will NOT find any TFSA information as that came about after the book was published)

woodpusher

TSC’s International Man of Meh

Another older book from Gordon Pape, who also wrote the one above ^^^^

Retirement's Harsh New Realities is from 2012 and more from the same songbook as well. He basically runs around complaining about broken pension systems (except if you are a federal employee), DB plans going bankrupt, self-administered DC plans being in the hands of employees who are unedumacated about investing, government benefit clawbacks and taxes on your savings when you go to use them, etc.....

Nothing new learned here. and even 4 years later the previous book, he still seems to misunderstand what an ETF is.

VERDICT: PASS

Up next.... no books , but digging into some research on vacationing in August down in Nova Scotia. Will look at Cape Breton rather than the Southern Shore for this trip, even though just outside of Halifax will be our base (niece's house).

, but digging into some research on vacationing in August down in Nova Scotia. Will look at Cape Breton rather than the Southern Shore for this trip, even though just outside of Halifax will be our base (niece's house).

Retirement's Harsh New Realities is from 2012 and more from the same songbook as well. He basically runs around complaining about broken pension systems (except if you are a federal employee), DB plans going bankrupt, self-administered DC plans being in the hands of employees who are unedumacated about investing, government benefit clawbacks and taxes on your savings when you go to use them, etc.....

Nothing new learned here. and even 4 years later the previous book, he still seems to misunderstand what an ETF is.

VERDICT: PASS

Up next.... no books